The IRS published a notice of proposed rulemaking, REG-110412-23, which proposes rules concerning the low-income bonus credit program under the Inflation Reduction Act, on June 1, 2023. The proposed rules expand on its earlier guidance set forth in Notice 2023-17. Comments on the proposed rules are open through June 30, 2023.

Background

Under the Inflation Reduction Act, new Internal Revenue Code (IRC) Section 48(e) established the low-income communities bonus credit—sometimes referred to as the environmental justice bonus credit. The credit allows a taxpayer or applicable entity eligible for direct pay under IRC Section 6417 with a qualified solar and wind facility to receive an increased income tax credit of between 10 and 20 percentage points. This bonus percentage is on top of the other bonus criteria, such as prevailing wage and apprenticeship requirements.

Qualified solar and wind facilities are defined in IRC Section 48(e) as facilities that meet all of the below and has been awarded an allocation of the annual capacity limitation:

- Generates electricity from a wind facility, solar energy property, or small wind energy property

- Has a maximum net output of less than five megawatts (MW) alternating current

- Is located in a low-income community (Category 1) or on Indian land (Category 2), is part of a qualified low-income residential building project (Category 3), or is a qualified low-income economic benefit project (Category 4)

The proposed regulations include definitions and further describe the allocation process for 2023. While the proposed regulations in REG-110412-23 are intended to supplement the guidance in Notice 2023-17, the Treasury Department and IRS are requesting comments on the proposed definitions and requirements and whether these should apply for purposes of the low-income community bonus credit program for 2024 and beyond. Further guidance will likely be issued later this year to establish a comprehensive set of rules and procedures for applicants.

Proposed Definitions and Requirements

Several definitions and requirements are included in the proposed regulations.

Facility

IRC Section 48(e) defines a qualified solar and wind facility, for which one part of the facility has a net output of five MW or less. The Treasury Department and IRS are concerned some applicants might attempt to circumvent the five MW cap by artificially dividing larger projects into multiple facilities. As a result, the proposed regulations include a rule to aggregate multiple projects or facilities into a single project or facility.

Whether multiple facilities or properties are operated as part of a single project depends on the relevant facts and circumstances and is evaluated based on the factors provided in Section 7.01(2)(a) of Notice 2018-59 or Section 4.04(2) of Notice 2013-29, as applicable.

Energy Storage Technology Installed in Connection with a Solar and Wind Facility

IRC Section 48(e) provides that eligible property includes energy storage technology installed in connection with a qualified solar or wind facility. Under the proposed definition of installed in connection with, the property is eligible if both of the following are true:

- The energy storage technology and other eligible property are owned by a single legal entity, located on the same or contiguous pieces of land, have a common interconnection point, and are described in one or more common environmental or other regulatory permits.

- The energy storage technology is charged no less than 50% by the other eligible property. A safe harbor is also proposed, which would deem the energy storage technology to be charged at least 50% by the facility if the power rating of the energy storage technology is less than two times the capacity rating of the connected wind facility or solar facility.

Financial Benefits for Category 3 and 4 Allocations

IRC Section 48(e) provides that electricity acquired at a below-market rate may be considered a financial benefit. Thus, definitions for financial benefit and electricity acquired at a below-market rate are proposed, as well as how such definitions are applied to qualified low-income residential projects and qualified economic benefit projects.

Category 3: Financial Benefits for Qualified Low-Income Residential Building Projects

The proposed rules require that at least 50% of the financial value of net energy savings are equitably passed on to the building occupants by distributing equal shares among the qualified residential property’s units or by distributing proportional shares based on each dwelling unit’s electricity usage.

Further rules are also proposed for situations in which the building owner and the qualified facility have the same or different ownership, and an agreement for distributing the savings must be in place.

The proposed rules also account for the impact of metering on the delivery of the financial benefit, whether master-metered or sub-metered, and indicate that the guidance issued by the United States Department of Housing and Urban Development should be followed.

Category 4: Financial Benefits for Low-Income Economic Benefit Projects

The proposed rules require low-income economic benefit project facilities to serve multiple households with at least 50% of total output distributed to qualified low-income households.

In addition, to further the goals of the program, the proposed rules reserve allocations under this category exclusively for applicants that provide at least a 20% bill credit for all such low-income households.

A method for calculating the bill credit discount is also proposed, including applicant verification of a household’s qualifying low-income status and submitting proof of meeting the requirements of the allocation.

The proposed regulations include several methods to verify eligibility, such as the verification of a household’s participation in a needs-based federal, state, Tribal, or utility program with income limits at or below the qualifying income level for the specific facility.

Location

The proposed rules include a nameplate capacity test for determining if the location requirements are met. Under the nameplate capacity test, a facility that has a nameplate capacity is considered located in or on the relevant geographic area if 50% or more of the facility’s nameplate capacity is in a qualifying area. The nameplate capacity of any energy storage technology installed in connection with the facility doesn’t affect the assessment of the nameplate capacity test.

The Allocation Process

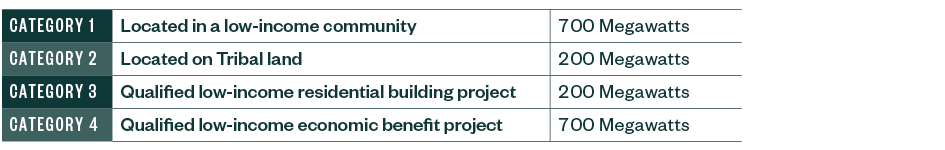

Consistent with Notice 2023-17, the 1.8 gigawatts of total allocation authority for 2023 is proposed to be reserved as follows:

Also consistent with Notice 2023-17, the proposed rules provide facilities placed in service prior to receiving an allocation aren’t eligible to receive an allocation, as those facilities don’t increase adoption of and access to renewable energy facilities as compared to the absence of the low-income communities bonus credit program.

The Selection Process

Notice 2023-17 proposed a phased application approach, but based on public feedback and operational capabilities to administer the program, the proposed regulations took a new approach.

The proposed approach includes an initial application window in which all applications received by a certain time are evaluated together. This would be followed by a rolling application process if the capacity limit isn’t fully allocated after the initial application window closes.

Furthermore, facilities that meet at least one of the two categories of additional selection criteria would receive priority for an allocation within each category. At least 50% of the total capacity limit in each category will be reserved for facilities that meet the additional selection criteria. Facilities meeting both additional selection criteria will have the highest prioritization.

The Treasury Department and IRS retain the discretion to reallocate the capacity limits across categories and sub-categories to maximize allocation if one category or sub-category is oversubscribed and another has excess capacity.

Additional Selection Criteria

Two categories of additional selection criteria exist, based on ownership and geographic location.

Ownership Criteria

A qualified facility meets the additional ownership criteria if it’s owned by a:

- Tribal enterprise

- Alaska Native corporation

- Renewable energy cooperative

- Qualified renewable energy company meeting certain characteristics

- Qualified tax-exempt entity

Specific definitions of each ownership category are provided in the proposed regulations.

Geographic Criteria

The geographic criteria are based on where the facility will be placed in service. To meet the criteria, a facility needs to be located in:

- A persistent poverty county

- A census tract designated in the Climate and Economic Justice Screening Tool as disadvantaged

Applicants who meet the geographic criteria at the time of application are considered to meet the geographic criteria for the duration of the recapture period unless the location of the facility changes.

Sub-Reservations for Allocation for Facilities Located in a Low-Income Community

It’s anticipated the largest number of applications will be received for Category 1 facilities located in low-income communities. Therefore, it’s proposed that 560MW of the 700MW capacity limitation be reserved for residential behind-the-meter (BTM) facilities, including rooftop solar.

The remaining 140MW capacity limitation would be available for applicants with front-of-the-meter (FTM) facilities.

Application Materials

The proposed regulations include certain documentation and attestation requirements when applying for an allocation. Some requirements differ for FTM or BTM facilities and other requirements differ based on the category and additional selection criteria. As a result, the proposed regulations set forth several tables outlining what information and attestations are required in the different scenarios.

Documentation and Attestations to be Submitted when Placed in Service

The proposed regulations require facilities to report to the United States Department of Energy when a facility is placed in service, along with additional documentation and attestations. Thus, final verification that facilities have met certain eligibility requirements could occur. The proposed regulations set forth several tables outlining what information and attestations would be required in the different scenarios.

Post-Allocation Compliance

There are several ways to be disqualified after receiving an allocation—as well as ways to trigger a recapture of the bonus credit increase.

Disqualification After Receiving an Allocation

To discourage material changes in project plans, such as significant reductions in facility size that tie up capacity limitations, the proposed rules set forth that a facility awarded a capacity limitation allocation is disqualified if, prior to or upon placement in service, one of several changes occur.

- The location where the facility will be placed in service changes

- The nameplate capacity of the facility increases such that it exceeds the less-than-five-MW alternating current output limitation or decreases by the greater of two kW or 25% of the capacity limitation awarded in the allocation

- The facility cannot satisfy the financial benefits requirements as planned

- The facility isn’t placed in service within four years after the date the applicant was notified of the allocation of capacity limitation

The facility can also be disqualified if it received an allocation based, in part, on meeting the ownership criteria and ownership of the facility changes prior to the facility being placed in service.

Recapture of Bonus Credit Increase

Per the proposed regulations, the following circumstances result in a recapture event if the property ceases to be eligible for the increased credit during the five-year recapture period:

- The property fails to provide financial benefits after its original placed-in-service date

- The property ceases to allocate the financial benefits equitably among the occupants of the dwelling units, such as not passing on to residents the required net energy savings of the electricity

- The property ceases to provide at least 50% of the financial benefits of the electricity produced to qualifying households or fails to provide those households the required minimum 20% bill credit discount rate

- The residential rental building or the facility it’s a part of ceases to participate in a covered housing program or any other housing program

- The facility increases its output such that the facility’s output is five MW alternating current or greater, unless attributable to a new facility under the 80/20 rule for retrofitted facilities

The proposal includes a one-time 12-month cure.

We’re Here to Help

If you have questions about this guidance or other related concerns, contact your Moss Adams professional.